Expert Real Estate Solutions

Buy, Sell, Funding and Foreclosure Assistance

Real Estate Solutions for Investors, Homeowners, Sellers, and Buyers. Grow Your Property Portfolio, Sell Fast, Get Financing or Protect Your Home from Foreclosure.

15+ Years of Real Estate Experience in Buying, Selling, and Foreclosure Assistance

Your Trusted Partner for Investing, Selling, and Saving Homes

With over a decade of experience, we provide strategic solutions for real estate investors, helping you build your portfolio, secure financing, and close deals quickly. From distressed properties to turnkey investments, we’re your go-to partner.

Explore Services Shaping Your Real Estate Future

Real Estate Made Simple. Whether You're an Investor Looking to Grow Your Portfolio, Selling a Property, Buy a Property or a Homeowner Facing Tax Foreclosure—We’ve Got You Covered.

Sell Your Property Quickly

Sell Your Owner Occupied or Investment Property Quickly for Cash. We Specialize in Fast Cash Offers for Homeowners and Real Estate Investors, Helping You Sell with No Hassles or Delays.

Foreclosure Relief Assistance

Tax Lien & Mortgage Help for Homeowners. Facing Foreclosure? We Offer Foreclosure Assistance and Solutions to Save Your Home. Our team will guide you through every step, offering real options to foreclosure.

Funding Options

Access competitive financing options designed to help you grow your portfolio.

Property Acquistion

Exclusive Off-Market Real Estate Deals for Investors.

Listing Options

List or Buy Your Property with a Professtional Licensed Realtor.

TEAM

Meet Our Expert

Real Estate Team

Meet Our Experienced Real Estate Professionals: 14+ Years of Buying, Selling, and Foreclosure Expertise

C. Thompson

S. Kumia

Testimonials

"They helped save my home from tax foreclosure. The process was smooth, and they provided amazing support."

T. Garfield

"Working with this team was incredible! I sold my investment property quickly and received a great cash offer."

S. Jacobs

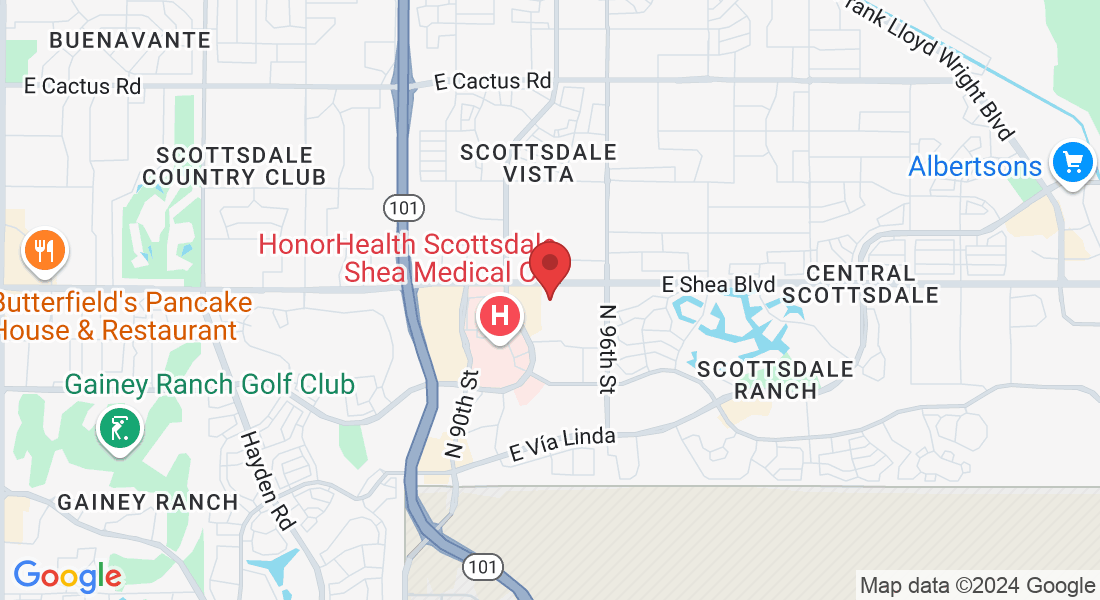

Post Address and Mail

Email: [email protected]

Address

Office: 9375 E. Shea Blvd Suite 100

Scottsdale AZ 85260

Get In Touch

Assistance Hours

Mon – Sat 9:00am – 5:00pm

Sunday – CLOSED

Phone Number:

844-207-4648

By submitting this form and signing up for texts and emails you consent to receive marketing text messages and emails from OnPurpose Real Estate Solutions at the number provided. Consent is not a condition of purchase. Msg & data rates may apply. Unsubscribe at any time by replying STOP. I agree to terms & conditions and privacy policy provided by the company.

Innovation

Fresh, creative real estate solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

Social Media Links

Yre

Contact Us

(844) 207-4648

9375 E. Shea Blvd Suite 100 Scottsdale, AZ 85260